In the fast-changing world of cryptocurrency, investors need clear measures to help them make smart choices.

One key measure is circulating supply. This shows how many coins or tokens are ready for trade at a specific time.

Knowing what circulating supply means helps everyone in crypto, from new users to expert traders. It helps them check market cap, assess liquidity, and judge the stability of a coin.

This article will explain the details of circulating supply. It will also look at its link to total supply and max supply.

Lastly, it will show why this measure is important for planning investments.

Circulating Supply Meaning

What is Circulating Supply and Why it is Important?

Circulating supply is the total number of coins or tokens available for use. These coins are accessible to the public through exchanges, wallets, and direct trades. This number is different from the total number of coins that could ever exist.

Circulating supply only counts crypto assets that are active and can be moved. This measure is important because it affects market price and market size. It also impacts how rare a token seems to be. A high circulating supply can make a token seem less rare.

On the other hand, a low circulating supply can create a feeling of scarcity. This feeling may lead to an increase in price over time.

Role in Cryptocurrency

In the blockchain world, miners or validators make tokens. They do this through mining and consensus methods. When new blocks are checked, new coins go into circulation. This increases the circulating supply of tokens. At the same time, token-burning methods take away some tokens from circulation. This lowers the circulating supply and may make tokens more rare. The balance between mining, minting, and burning decides how many tokens users can buy, sell, or trade.

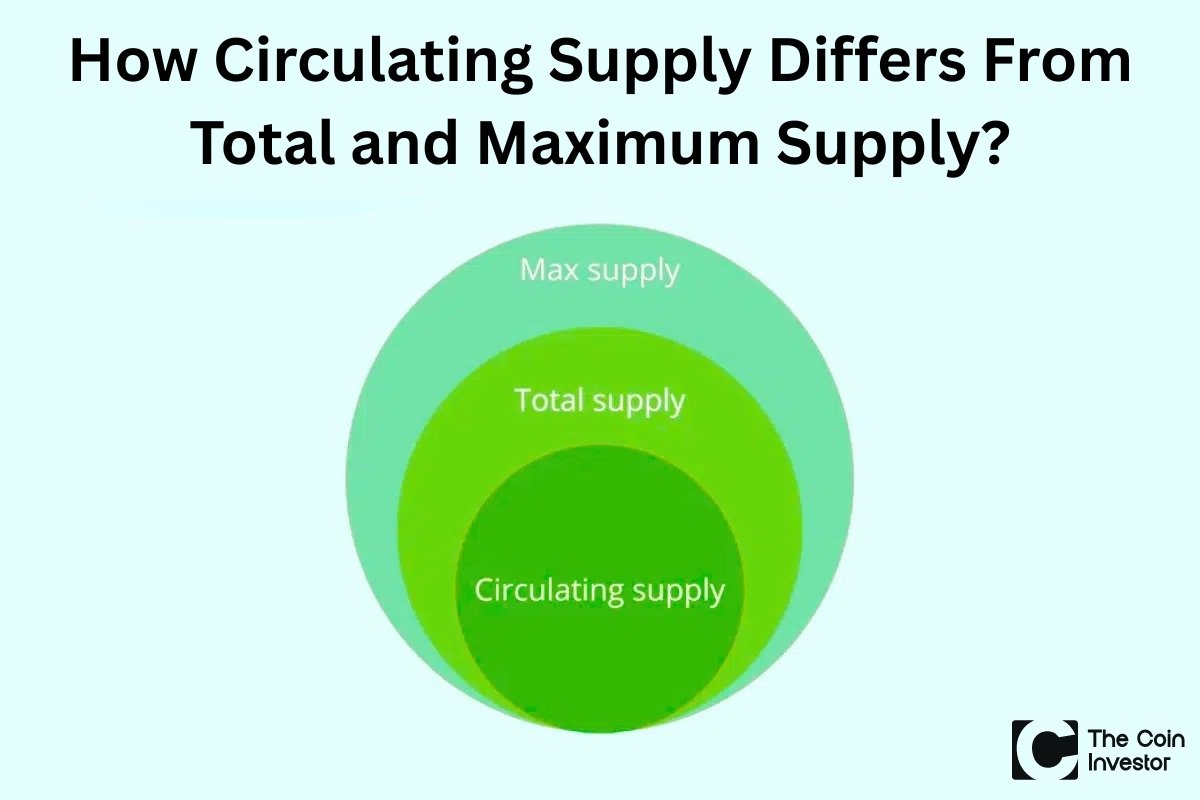

How Circulating Supply Differs From Total and Maximum Supply?

- Total supply is the aggregate number of tokens that have been created minus any coins that have been burned. It includes coins held by project teams, locked tokens for development, and staked assets.

- Maximum supply (or max supply) denotes the cap on the total number of coins or tokens that will ever be generated on a blockchain. For instance, Bitcoin’s maximum supply of 21 million BTC represents the uppermost limit of bitcoin issuance.

Circulating supply sits between these concepts, representing only the subset of total supply that is live in the crypto market.

Why Circulating Supply Matters For Investors?

Impact on Market Capitalization

Market capitalization, or market cap, equals the current price multiplied by circulating supply. This formula underscores the importance of circulating supply: as the circulating number of coins rises, so does market cap—assuming price remains constant. Conversely, a surge in circulating supply without corresponding demand can depress market price, leading to stagnating or shrinking market cap.

Role in Assessing Coin Liquidity and Scarcity

Liquidity depends on the number of tokens that are available. It also relies on how easily they can be bought or sold. If a token has a small market cap but a high circulating supply, it may provide good liquidity.

On the other hand, a coin with low circulating supply can be hard to trade and have big price changes. Scarcity happens when the circulating supply is low compared to the total supply.

This can make prices move a lot when demand goes up.

Investors who want stability in a cryptocurrency usually like projects that have balanced circulating supply and a strong total number of coins.

Factors Affecting Circulating Supply

Mining, Minting, and Burning Tokens

- Mining and minting: On Proof-of-Work blockchains like Bitcoin (BTC), miners secure networks and mint new coins, increasing circulating supply. On Proof-of-Stake chains, validators mint new tokens by staking, similarly expanding supply.

- Burning: Projects like Binance Coin (BNB) routinely burn tokens, removing them from circulation to reduce circulating supply and support market price.

These mechanisms directly shape the number of tokens that traders can access via exchanges and wallets.

Locked, Staked, and Reserved Coins

A large part of the total coins may be locked by the rules. Some coins are saved for teams that build the project. Others are tasked to help keep networks safe. These locked and staked coins cannot be traded or moved until they are released.

Because of this, the real circulating supply is usually less than the total supply. This affects both the market value and how rare the money is.

How Cryptocurrency Prices Are Calculated (In Relation To Circulating Supply)?

Circulating supply means the total number of coins or tokens that are now available. These coins are found on the blockchain.

They can be held in wallets, exchanges, and peer-to-peer trades. This is different from total supply.

Total supply is made up of created coins minus those that are burned. Maximum supply refers to how many will ever exist.

Circulating supply impacts market cap. Market cap is found by multiplying the current price by the circulating supply. This makes it important to look at liquidity, scarcity, and stability. Miners and validators help increase circulation by mining and giving rewards.

However, burning, staking, and keeping reserved coins can reduce circulation. These changes affect trading availability and market prices. They also shape investment choices in cryptocurrency.

Cryptocurrency prices are set by bids and asks in the order book. These bids and asks match buy and sell orders.

The market cap is found by multiplying the current price by circulating supply. Investors can find the value of a token using this formula: price per token equals market cap divided by circulating supply.

Changes in circulating supply can affect value. This can happen due to miner releases, minting, or burning, unless demand changes too.

Order book depth and liquidity also affect price impact and slippage. A high circulating supply usually means better liquidity.

On the other hand, a low supply can cause rarity and price swings. Knowing about circulating supply, total coin count, and max supply is key for smart investment choices in bitcoin, altcoins, and the wider crypto market.

Conclusion

Circulating supply is a cornerstone metric in the cryptocurrency market.

By revealing the number of coins actively trading, it underpins market capitalization calculations, influences liquidity and scarcity, and provides crucial insight for investment decisions.

Whether evaluating bitcoin’s disruptive potential or assessing emerging altcoins, investors must always consider circulating supply alongside total supply and max supply metrics.

Armed with clarity on circulating supply meaning, crypto enthusiasts can chart more informed paths through the digital asset revolution.

FAQ’s:

Why is Circulating Supply Important When Evaluating Cryptocurrencies?

Circulating supply shows how many tokens are open to the public. This number affects market size, money flow, and how rare the tokens seem. It also plays a big role in price changes and choices made by investors.

Can Circulating Supply Change Over Time?

Yes. Circulating supply can go up or down. This happens through mining, minting, token releases, and burning events. Changes in supply can affect the market cap. They also change how rare a coin is.

Is High Circulating Supply Good?

A high circulating supply can help with trading. It makes sure there are enough tokens available. But if demand does not keep up with supply, it can lower token value. This may also drop the market price.

How Does A High Or Low Circulating Supply Affect A Coin’s Price?

Low circulating supply can amplify price increases during demand surges due to heightened scarcity, while high circulating supply may require greater demand to drive price gains and risks price dilution.

How Do Circulating and Total Supply Affect Price?

Circulating supply is key for figuring out market cap. It also shows how much crypto is available to buy. Total supply shows all coins made, minus any that are burned. This helps to see how many coins may be used in the future. These numbers help investors understand how rare a coin is. They also look at future price changes and how stable the coin might be.

What Does Circulating Supply Tell You?

Circulating supply shows how many cryptocurrency coins or tokens are available for trading. It tells apart those that are locked, saved, or not issued. This number is used in the market cap formula. The formula is market cap = current price × circulating supply. It affects a coin’s market value, liquidity, and price changes directly. This measure helps investors see risks of dilution and rarity in their choices.