The cryptocurrency market starts 2025 with strong growth. This is due to more businesses using crypto and clearer rules.

Bitcoin has gone up past $107,000. This rise pushes the total market value over $3.20 trillion.

Many are hopeful for a great year for digital money, even with some ups and downs. Key reasons for this include support from the U.S. government, more ETF approvals, and better blockchain tech.

As smart contracts become more popular, experts say prices for cryptocurrencies will rise.

By the end of 2025, crypto may change from risky choices to regular finance tools. Blockchain and smart contracts are used more in different fields.

Big Wall Street firms now see crypto as a real investment. They also view it as a way to protect against economic troubles. Market trends show that 2025 could bring more than just higher prices.

Analysis shows strong support for top cryptocurrencies. The greed index shows good feelings among investors, but they are not taking too many risks. Changes in U.S. rules may bring in big investments. In the past, Bitcoin halvings have led to large gains. Current supply patterns hint at continued price growth.

Crypto Price Predictions for 2025

1. Bitcoin (BTC)

Bitcoin’s price for 2025 looks bright.

Experts think the price of bitcoin will be between $115,000 and $135,000. It may even hit $200,000 by the end of the year.

Right now, Bitcoin is stable at $101,500 to $106,800. This stability helps build a strong base for growth. More interest from big investors is boosting this view. New ETF funds are also coming in to help support it. Bitcoin has a limited supply because of its halving rule. This matches the growing demand from traditional finance.

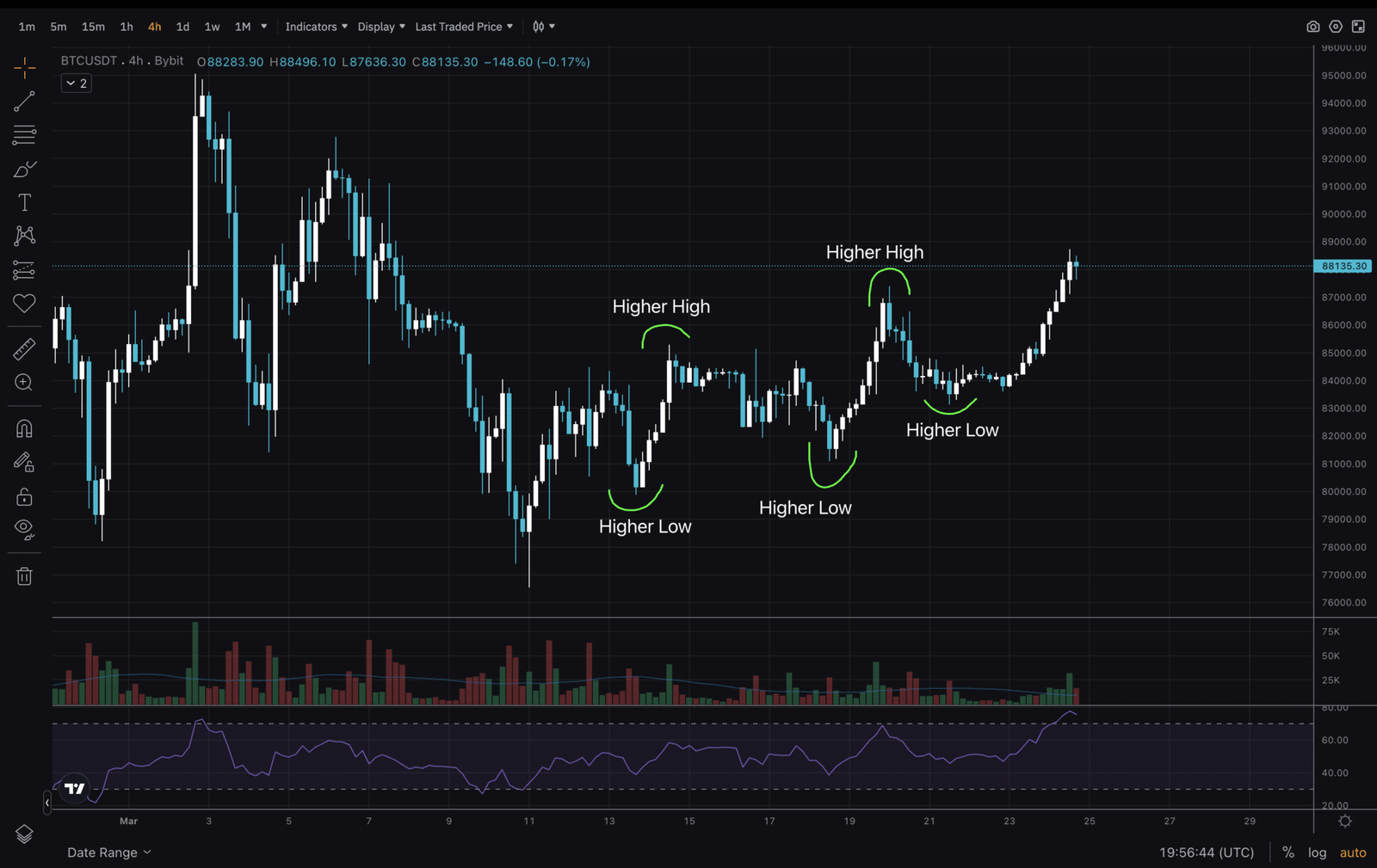

Technical signs show positive energy for Bitcoin. Important support levels stay strong even with short-term ups and downs.

Big firms on Wall Street are putting a lot of money into Bitcoin as a safe asset in tough economic times.

Central banks may make Bitcoin more appealing as a shield against rising prices and weak currencies.

Bitcoin has been strong during tough times in the past. It is now seen as a high-risk, high-reward type of asset for its limited supply and compared to gold for saving wealth over time.

Well-known companies like ARK Invest keep their positive views about Bitcoin’s future. They point to tech improvements and new rules as drivers for growth.

The link between larger economic factors and Bitcoin’s price gets stronger as regular investors start to see cryptocurrency as a real choice for investment.

2. Ethereum (ETH)

Ethereum’s price for 2025 looks very bright.

Predictions say it will range from $6,200 to $9,345. This shows a lot of possible growth ahead. Ethereum is a leader in decentralized finance. It has a strong system that supports many apps and rules. Experts believe Ethereum might gain speed after its halving event.

This could be like what bitcoin did before. Growth is expected all through the year. The network is upgrading to handle more users better. This makes Ethereum a key part of the Web3 economy.

Positive feelings in the market are boosted by more institutions using Ethereum. ETF products let regular investors easily access cryptocurrency. Price changes often follow broader DeFi trends.

Most decentralized apps driving changes in digital assets are on Ethereum. Layer-2 solutions improve its value as an important blockchain tech. Beyond payments, Ethereum also supports various apps, like NFTs and advanced financial tools. Past data shows that Ethereum does well in good markets, making it a great choice for investors wanting crypto growth.

3. Solana (SOL)

Predictions for Solana’s price in 2025 look bright. Estimates are between $121 and $495. Some hopeful guesses even reach $1,000. Solana is known for its fast blockchain, especially in the short term. This attracts many developers and users. They enjoy quick transactions and low fees.

Signs in the market show a strong cup and handle pattern. This may lead to big price jumps as more big companies look at new blockchains. Good market trends are pushing developers to leave busy networks. They want better and faster choices.

The platform has a range of apps and finance tools that help these positive views. Seven trusted experts average a price of $515, showing a lot of faith in Solana’s tech and market strength.

Speculation about ETF approvals could boost Solana’s market capitalization. Despite competition in layer-1 solutions, positive investor sentiment remains due to Solana’s capacity for significant growth and high transaction volumes at low fees, positioning it for widespread adoption.

While Bitcoin movements typically influence Solana’s performance, the platform is gaining independence as its ecosystem evolves and attracts dedicated users and developers.

4. Dogecoin (DOGE)

Dogecoin’s price prediction for 2025 shows how social media and famous people impact crypto markets. Predictions say DOGE might be between $0.14 and $1.58. The average price is about $0.25. Its price often changes like trends on social media platforms.

It is also affected by comments from big names, like Donald Trump, who supports crypto use. The strong community behind Dogecoin helps shape market feelings. Its ability to go viral is good for its growth. Even though it has no limit on supply, this makes long-term growth tough.

However, its low price attracts many small investors. Analysis shows it usually follows overall market trends, especially during hype times. Big companies still do not use Dogecoin much when compared to more known coins.

However, if major stores accept it as payment more often, this could help raise its price. The wide range of guesses shows how meme coins are risky and can change fast with the market. Past data shows that Dogecoin often grows quickly during good market times, making it a high-risk but high-reward choice for investors.

5. Ripple (XRP)

XRP’s price predictions for 2025 show hope due to new rules and bank use. Experts expect prices between $2.2 and $15. The average guess is about $4.5, which means there is a lot of room to grow from now. With the former SEC head Gary Gensler gone, the mood is better for XRP’s rise. A friendly government for crypto helps too. More big banks see how useful XRP can be for payments across borders.

Market conditions have gotten much better after clear rules came out in the U.S. XRP stands out in payments, and Ripple’s ties with banks help boost price hopes for next year.

Signs show that XRP has solid support right now. It could gain from more trust as legal issues fade away. As the crypto market grows up, XRP benefits from more banks using it. Its price also shows how people feel about rule changes and bank connections.

The long-term outlook is good because blockchain tech mixes more with regular finance, which may raise its market size and trade amounts.

6. Cardano (ADA)

Cardano’s price prediction for 2025 shows its careful growth and wider use in apps. Experts believe ADA will range from $0.735 to $1.376. The average price is around $0.945. Its proof-of-stake system is focused on being green.

This helps it earn trust from big firms as people worry about the environment. Studies show that Cardano has much room to grow. Its DeFi platform keeps attracting more builders and users every day.

Even with strong rivals in smart contracts, people are still positive about ADA. Its ties to market trends mean it could rise a lot if crypto grows in 2025. More big companies are taking notice as Cardano shows real uses, like managing IDs and tracking goods in supply chains.

Price guesses vary due to risks from other systems. Still, tech progress and clear rules might help raise its value. Past data shows Cardano often has slow but big price jumps during strong market times.

7. Binance Coin (BNB)

BNB price predictions for 2025 show a good chance of rising. The price may range from $581 to $1,000. BNB is the main token of Binance, the largest crypto exchange. It benefits from the growth of Binance’s services and ecosystem.

Technical signs suggest a cup and handle pattern. This pattern could mean big price jumps if certain levels are broken. Good market conditions and higher trading volumes help support growth.

Binance’s global reach also adds to this support. Although BNB’s use by big firms is less than Bitcoin and Ethereum, it is gaining value. More people see exchange tokens as useful assets, which may increase interest in BNB. The shift in the crypto world toward utility raises BNB’s worth in the Binance ecosystem. Price models show that BNB can grow a lot if the overall market stays positive. Strong support levels will help its rise throughout the year.

8. Polkadot (DOT)

Polkadot’s price outlook for 2025 has great chances for buyers. Investors are keen on blockchain links. Price predictions range from $4.14 to $13.90. Important Fibonacci levels show key resistance spots. Polkadot has a unique way of joining blockchains. This gives it a strong chance for growth as the crypto world evolves. It aims to improve network links. Technical signs suggest a possible W-reversal pattern.

This could lead to big price jumps if it happens. Market feelings towards DOT are hopeful yet cautious. This is thanks to ongoing work on its parachain system. There is growing interest from big firms in link solutions too.

As more people use blockchain, Polkadot may thrive in the complex crypto market. It can help fix connection issues between networks. While DOT prices often follow broader altcoin trends, its unique value could let it move independently. Past data shows that Polkadot usually has wild but good performance during bull markets.

9. SHIBA INU (SHIB)

Shiba Inu’s price forecast for 2025 shows the charm of meme coins in crypto. Experts expect an average price of $0.0000399 by the end of the year. This suggests high potential gains for investors.

The token’s rise is driven by its strong community and growing ecosystem, which help raise prices. Market feelings, shaped by social media trends, are very important for its success. Technical studies show a clear link between Shiba Inu and market emotions, along with trading habits based on speculation.

Although its large supply limits big price jumps, community support can keep it alive. Even with limited use by big firms, more people accepting other crypto assets might improve Shiba Inu’s future.

Expert views show the doubt around meme coin investments; predictions are very different. Some see Shiba Inu as a risky bet while others see its rising use and worth. In the past, meme coins have often grown during times of hope and social media excitement.

10. Litecoin (LTC)

Litecoin’s price prediction for 2025 sees it as digital silver to Bitcoin’s digital gold. Experts forecast a trading range from $76.60 to $199.06. There may be higher prices if market conditions are good. Litecoin has a solid track record and its tech appeals to cautious investors.

These investors look for stable options in crypto. Technical signs show a possible W-reversal pattern, which hints at big price gains in 2025. Good market feelings support Litecoin as a trusted payment method and safe asset.

More institutions are also showing interest in its use and stability. As the crypto market grows, Litecoin benefits from its name and proven tech. Its price changes often follow Bitcoin’s but with less wild swings, making it appealing for those avoiding risk. Past data shows that Litecoin usually does well during late bull markets, setting it up for growth ahead.

Factors Influencing Crypto Prices in 2025

- Global Economic Trends: Crypto prices in 2025 will lean on the world economy. If interest rates drop, people might buy more crypto for better returns. Stuff like inflation, job numbers, or recessions can shake confidence. U.S. policies favoring crypto (like clearer rules) could boost prices, while global trade wars or inflation might cause crashes.

- Technological Advancements: Better blockchain tech (faster transactions, smarter contracts) makes crypto more useful. Upgrades like Ethereum’s efficiency or Solana’s speed attract users and investors. New features (privacy tools, AI integration) add value, pushing prices up. But tech flaws or hacks could hurt trust.

- Regulatory Changes: Friendlier rules (like U.S. approving Bitcoin ETFs) invite big investors, stabilizing Bitcoin’s value and prices. Strict bans or unclear laws in major countries might cause panic selling. Global teamwork on crypto laws (like Europe’s MiCA) helps markets grow safely.

- DeFi & NFT Trends: DeFi platforms (loans, trading without banks) and NFTs (digital art/collectibles) drive crypto use. If these sectors boom, related coins (Ethereum, Solana) could spike. But scams or failed projects might scare investors away.

- Market Sentiment: Prices swing with crowd psychology. Social media hype (like Elon Musk tweets) or fear (e.g., “Bitcoin will crash!” headlines) can cause sudden jumps or drops. Tools like the “Fear & Greed Index” track if investors are buying out of excitement or panic.

- Institutional Adoption: Big companies (like MicroStrategy) or Wall Street funds pouring money into crypto add significant role stability. More crypto ETFs or payment options (Visa using blockchain) boost prices. If institutions sell suddenly, prices could crash.

- Supply & Demand: Bitcoin’s limited supply (only 21 million) keeps it valuable. For coins like Dogecoin (unlimited supply), prices depend more on hype. Events like Bitcoin “halving” (fewer new coins) often push prices up.

- Competition & Innovation: New coins with better tech (faster, greener) can steal attention. If Bitcoin stays dominant, it holds value. If a coin solves big problems (like high fees), it might surge. Failed projects fade away.

- Environmental Factors: Crypto’s energy use (Bitcoin mining) faces criticism. Greener coins (Ethereum post-upgrade) might attract eco-conscious investors. Climate rules targeting crypto could hurt polluting coins.

- Real-World Use: Crypto’s price rises if used for everyday things (payments, contracts). Countries adopting crypto as legal tender (like El Salvador) help. If crypto stays a “niche” investment, prices stay volatile.

How to Predict Crypto Prices?

Cryptocurrency price prediction requires a clear approach, including technical analysis, fundamental research, and market sentiment checks. Tools like moving averages, RSI, and MACD reveal price trends. While past data can identify patterns, it doesn’t guarantee future performance in this volatile market.

Fundamental analysis assesses cryptocurrencies’ true value through technology, usage rates, and real-world applications. Examining market cap helps compare the value and growth potential of different coins.

On-chain analysis provides insights into network activity and investor behavior that other methods may overlook. Price prediction models utilize mathematical formulas and machine learning to analyze extensive market data for clearer price forecasts.

Combining various methods enhances accuracy while mitigating individual limitations. Effective crypto price prediction requires continuous adaptation to new market realities and influences on asset values.

Chances of Crypto Crash: 2025

The cryptocurrency market is at risk of a crash in 2025 due to economic issues and unclear regulations. In April, Bitcoin fell 30% to $74,000, highlighting its vulnerability to trade problems and recession fears.

Tariff wars also contributed to a 5.5% decline.

Experts predict Bitcoin may correct to between $75,000 and $80,000, citing patterns like W-reversals and liquidation cascades that wiped out $2.2 billion in positions. Increased regulatory scrutiny and security concerns heighten these risks.

Some forecasts suggest Bitcoin could plummet to $20,000 if panic selling occurs, similar to the 75% drop in 2018. However, institutional adoption and strong technology may mitigate the effects of a crash.

Bitcoin ETFs attracted $5.4 trillion in volume in Q1 2025, while Ethereum upgrades and Solana’s speed bolster the market.

Historically, crypto markets recover within 6 to 12 months, supported by $1.5 billion weekly ETF inflows and clearer regulations from over 70 countries. While a 25% to 30% drop seems probable, a total collapse is unlikely; Bitcoin remains stable at $109,000 thanks to corporate treasury investments.

Impact of External Markets on Cryptocurrency

Influence of Stock Markets

The connection between stock markets and crypto prices has strengthened as major companies adopt digital assets. Stock fluctuations increasingly influence crypto, especially during economic uncertainty. Major indexes like the S&P 500 now impact Bitcoin’s price.

Large investors see crypto as an alternative asset, and Wall Street’s acceptance enhances capital flow between traditional and digital markets during risky periods.

Research indicates a growing correlation between stock indexes and crypto prices, particularly in challenging times. Positive sentiment in stocks benefits the crypto sector, acting as a safety net during declines. Interest from large firms in both markets shapes investment strategies and reinforces their interdependence.

Effects of Commodity Prices

Commodity prices increasingly affect cryptocurrency values as digital assets become alternative stores of value. Gold trends significantly influence Bitcoin’s appeal, with investors weighing gold’s safe-haven status against crypto’s limited supply.

Market sentiment around commodities often reflects broader economic concerns impacting crypto prices. Oil price changes also affect cryptocurrencies by influencing global growth and costs. During global unrest, the link between crypto and commodity markets strengthens as investors seek alternatives to traditional finance.

Technical indicators suggest shifts in commodity prices often precede changes in crypto markets.

Additionally, agricultural and industrial goods drive crypto adoption in emerging markets, where digital assets can replace weak currencies. Understanding the relationship between commodity cycles and crypto price forecasts is essential for informed long-term investing.

Relationship with Fiat Currency Fluctuations

Fiat money strength, like the US dollar, affects crypto prices. Digital coins are seen as choices to regular cash. Interest rate rules shape both cash and crypto markets. This is due to global money flow and risk choices.

The crypto market often grows when there are fears of money loss and rising prices. This makes investors look for safer ways to keep value. Studies show that big changes in fiat can cause major shifts in crypto prices. Investors change their assets based on value checks. How people feel about fiat money also affects how firms use cryptocurrencies for savings and investments.

The link between currency markets and crypto prices changes with economic states and world events. When emerging market currencies are unstable, more people turn to cryptocurrencies for safety from falling local money values.

The global nature of the crypto market creates complicated ties with many fiat currencies. This impacts how different regions adopt cryptocurrencies and how prices move. Knowing these ties is key for predicting crypto trends and finding good investment chances in various economies.

Conclusion

The cryptocurrency market in 2025 has special chances for investors. Digital assets are gaining more trust and support from big firms. Technical analysis shows strong growth, helped by better market conditions and clear rules. Bitcoin price forecasts range from $115,000 to $200,000. This shows rising faith in crypto as a safe asset and a way to diversify investments.

Even with regular price changes, good market feelings remain strong. This is due to more big firms using crypto and wider acceptance by the public. Different price forecasts for various cryptocurrencies show many chances in this digital asset world. Well-known coins like Bitcoin and Ethereum, along with new platforms like Solana and Cardano, each have their own growth chances.

Investment plans for 2025 should mix quick trades with plans for long-term wealth. Technical signs suggest steady growth trends while basic analysis backs up ongoing use of the crypto industry. The mix of old finance with blockchain tech could boost crypto value and steady the market through more big firm involvement.

FAQs

What is the most promising cryptocurrency for 2025?

Bitcoin is the top cryptocurrency for 2025. This rise is due to big companies using it, clear rules, and smart price checks. Predictions suggest prices could be between $115,000 and $200,000. Ethereum also shows great promise. Its smart contracts and DeFi apps are strong points. Experts predict its price could reach $9,345. In the end, your choice will depend on your risk comfort and investment aims. Cryptocurrencies have many different risk-reward profiles.

Where Will Bitcoin Go in 2025?

Bitcoin price predictions for 2025 show the current bitcoin price may trade between $115,000 and $135,000. This range is based on the market today and how stores use Bitcoin. Some signs point toward a target of $200,000 by the end of the year. This will happen if strong buying continues. Limited supply and growing demand from big firms are also factors. More money coming in through ETFs helps too. All these reasons make it likely that prices will keep going up in the next few months.

What are the risks of investing in cryptocurrencies in 2025?

Cryptocurrency investments come with big risks. These include high ups and downs in price, rules that can change, and tech problems. These issues can impact how prices move, including Bitcoin’s price movements. Market feelings can change fast. This can happen because of news, social media, or economic factors. Even though big companies using crypto might lower some risks, the market is still more unstable than regular financial products. Also, just because something did well before does not mean it will do well again.

Can cryptocurrency replace fiat by 2030?

It seems unlikely that fiat money will be fully replaced by cryptocurrencies by 2030. This is due to how people are using them now and the rules in place. However, digital assets may become more important in global finance. This could happen through central bank digital currencies and the use of private cryptocurrencies. It is likely that blockchain will mix with traditional finance. We might see new hybrid systems instead of total replacements.

Should you invest in cryptocurrency?

Cryptocurrency investment choices must match each person’s money needs, risk levels, and goals. They should not rely on common market guesses. Although 2025 crypto forecasts show good signs, future investors need to do careful research. It is also important to mix cryptocurrencies in their investment plans. Because digital markets can be hard and change quickly, getting advice from a pro is key.