Wondering if now’s the time to sell your Ethereum? You’re not alone. With ETH hovering near $2,600 and buzz around Ethereum ETFs shaking up the crypto market, investors are weighing their options.

Ethereum’s wild price swings, driven by Bitcoin’s moves, regulatory changes, and its own tech upgrades (like smart contracts and DeFi apps), make this a tricky call.

Whether you’re eyeing profits, nervous about volatility, or tempted to swap ETH for USDT or for Bitcoin, your decision hinges on a mix of personal goals, market conditions, and timing.

Historical trends suggest May or September 2025 could be pivotal months, but there’s no one-size-fits-all answer.

Let’s break down the key factors—from tax implications to technical analysis—to help you navigate this crossroad confidently.

Should I Sell my Ethereum?

Making the decision to sell your Ethereum requires careful consideration of multiple factors.

As of April 2025, ETH prices have seen notable movement, prompting many to question if now is the right time to convert their digital assets to fiat currency or other cryptocurrencies like Bitcoin.

Looking at historical data, Ethereum often follows cyclical patterns that can provide insights for timing your sales.

Research Suggests Ethereum and Bitcoin frequently hit bottoms or tops against each other in December, with significant price movements occurring approximately 150-175 days following these December bottoms. This historical pattern suggests May 2025 could potentially be an optimal time to sell Ethereum based on previous cycles.

However, making this decision requires more than just following historical patterns. Your personal financial situation, investment timeline, and belief in Ethereum’s long-term value proposition all play important roles in determining whether selling is the right move for you.

How to Sell Ethereum For USD?

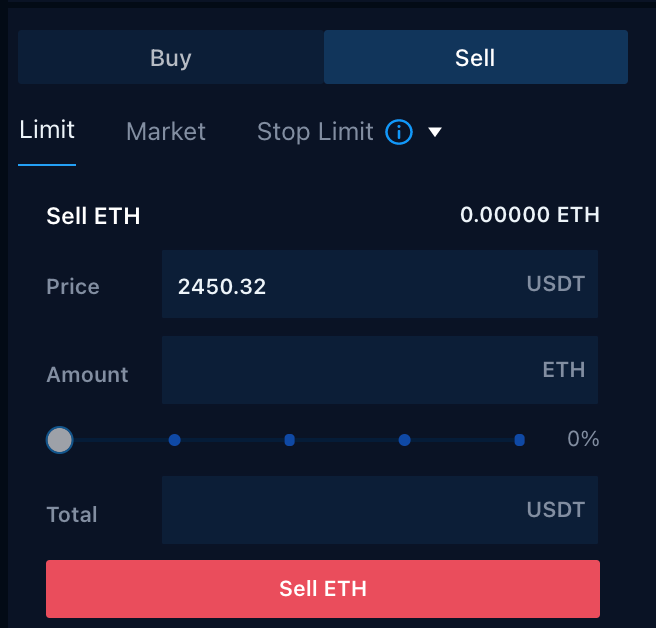

Converting your ETH to USD (USDT or any other stable coin) involves several straightforward steps across various platforms. Most cryptocurrency exchanges offer simple processes for selling your digital assets.

To sell Ethereum for USD, you’ll first need to ensure your ETH is available in your wallet. This could be a hardware wallet, paper wallet, or directly on an exchange account.

Once your ETH is accessible, you can:

- Select a reputable exchange or platform

- Transfer your ETH to the exchange (if not already there)

- Navigate to the sell or trade section

- Select ETH as the asset to sell and USD as the receiving currency

- Review the current exchange rate and fees

- Complete the transaction

- Withdraw USD to your bank account

Many platforms offer “Instant Sell” options that allow for quick conversion to USD with the funds being deposited directly to your debit card or bank account. These services typically refresh rates every few seconds to ensure you’re getting current market prices.

Before proceeding with any sale, always check the ETH to USD price chart to ensure you’re selling at favorable market conditions.

Where & When to Sell ETH?

Where to Sell ETH?

Selecting the right platform to sell your Ethereum is important for maximizing returns and ensuring security.

When choosing a platform, prioritize these key features:

- Security measures: Look for exchanges that implement mandatory verification, two-factor authentication, and secure storage solutions

- Regulatory compliance: Ensure the platform has proper registrations and licenses to operate legally

- Payment options: Choose exchanges that offer multiple withdrawal methods to your preferred payment method

- Reputation: Check reviews on platforms like Reddit and TrustPilot to verify user experiences

- Fee structure: Compare transaction fees across platforms to maximize your returns

Popular exchanges for selling ETH include established platforms like Binance, CEX.IO, Bitget, and Paxful, each offering different advantages depending on your specific needs.

When to Sell ETH?

Timing your Ethereum sale can significantly impact your returns.

While predicting the exact right moment is impossible, several approaches can guide your decision:

- Historical cycles: Data suggests that Ethereum price movements often follow patterns tied to Bitcoin halving events. Based on previous cycles, some analysts suggest September 2025 (500 days after the April 2024 Bitcoin halving) is an advantageous time to sell cryptocurrencies.

- Technical indicators: Watch for signs of overbought conditions or declining momentum in ETH price movements.

- Market sentiment: Monitor news and developments in the Ethereum network that might affect prices.

- ETH/BTC ratio: The ratio between Ethereum and Bitcoin can provide insights. Currently, around 3.8% (down from previous cycle highs of approximately 9%), this metric helps track Ethereum’s relative performance.

Remember that market conditions change rapidly in crypto, requiring thorough research and continuous monitoring to optimize selling timing.

What to Consider When Deciding Whether to Sell Your Ethereum?

Investment Goals

Your investment goals should fundamentally drive your decision about selling Ethereum. Consider:

- Short-term vs. long-term objectives: Short-term traders might sell ETH when it hits price targets, while those using a HODL strategy might wait through market fluctuations for long-term growth.

- Personal financial targets: Define clear price points or portfolio allocation targets that align with your broader financial planning.

- Diversification needs: Evaluate whether selling some ETH to diversify into other assets aligns with your investment strategy.

Your investment timeline also matters significantly. If you’re investing for retirement or long-term wealth building, short-term price fluctuations may be less relevant than if you’re trading actively or need funds for upcoming expenses.

Tax Implications

Selling Ethereum triggers tax consequences that require careful planning:

- Capital gains tax: In many jurisdictions, including the United States, selling ETH may result in capital gains tax ranging from 10% to 37% depending on your income level and how long you’ve held the asset.

- Tax-loss harvesting: If Ethereum’s price has dropped since purchase, selling at a loss could offset capital gains from other investments, potentially reducing your overall tax burden.

- Record-keeping: Maintain detailed records of all crypto transactions, including purchase dates, amounts, and sale information for accurate tax reporting.

Always consult with a tax professional familiar with cryptocurrency regulations in your jurisdiction before making significant sales.

Personal Risk Tolerance

Your comfort with market volatility should influence your selling decisions:

- Market volatility assessment: Ethereum can experience dramatic price swings—if these fluctuations cause significant stress, selling some or all of your holdings might align better with your risk profile.

- Portfolio allocation: Consider what percentage of your total investments is in cryptocurrency and whether that aligns with your risk tolerance.

- Financial security: Ensure you’re not overexposed to crypto volatility, particularly if you might need access to those funds in the near future.

Technical Analysis, Predictions, and Trends

Technical analysis can provide valuable insights when deciding whether to sell:

- Chart patterns: Monitoring support and resistance levels can help identify potential selling opportunities.

- Momentum indicators: Tools like Relative Strength Index (RSI) can signal when Ethereum might be overbought or oversold.

- Market trends: Current developments in the Ethereum ecosystem, such as the transition to Ethereum 2.0 and SEC approvals of Ethereum ETFs, may significantly impact future prices.

Current predictions from analysts vary widely, with some experts projecting Ethereum to reach over $20,000 by 2030, suggesting potential long-term growth prospects.

Key Signs That May Indicate It’s Time to Sell Ethereum

Some clear signs can help you know when to sell your Ethereum.

Technical Analysis Indicators

Several technical indicators may signal optimal selling opportunities:

- Overbought conditions: RSI readings consistently above 70 might indicate Ethereum is overvalued and due for a correction.

- Trend reversals: Breaking below key moving averages or trendlines could signal a changing market direction.

- Volume analysis: Decreasing volume during price increases might indicate weakening buying pressure.

- Historical cycle timing: Data suggests that approximately 150 days after December bottoms in the ETH/BTC ratio could be favorable selling points, potentially indicating May 2025 as a strategic time to consider selling.

Major Market Shifts

Significant market events often warrant reevaluating your Ethereum position:

- Correlation breaks: When Ethereum stops following its typical correlation patterns with Bitcoin or the broader market.

- Extreme volatility: Unprecedented price movements, such as the 22% spike seen on May 21, 2024, following ETF announcements, can sometimes signal market tops.

- Institutional positioning: Major changes in how institutions and large investors are approaching Ethereum.

Personal Financial Needs

Your financial situation might necessitate selling regardless of market conditions:

- Emergency fund requirements: If you need to build or replenish emergency savings.

- Major life expenses: Upcoming costs like education, housing, or other significant investments.

- Debt management: Selling ETH to reduce high-interest debt might be prudent depending on your financial situation.

Regulatory Changes Affecting Ethereum

Regulatory developments can significantly impact Ethereum’s value and utility:

- SEC decisions: Recent developments like the May 2024 SEC approval for Ether Spot ETFs represent significant regulatory milestones that affect market sentiment.

- Tax law changes: New taxation approaches to cryptocurrency might alter the financial equation for holding versus selling.

- International regulations: Changes in global regulatory approaches to cryptocurrency and blockchain technology.

Strategies for Selling Your Ethereum

1️⃣ Stop Loss

A stop loss strategy provides protection against significant downside risk:

- Predetermined price points: Set specific price levels at which your Ethereum will automatically sell, preventing further losses in declining markets.

- Trailing stop losses: These adjust upward as Ethereum prices rise, helping lock in gains while still providing downside protection.

- Implementation: Most major exchanges offer stop loss order functionality that executes automatically when triggering conditions are met.

2️⃣ Dollar-Cost Averaging (DCA)

DCA applies not just to buying but also to selling Ethereum:

- Scheduled sales: Sell fixed amounts of ETH at regular intervals regardless of price, helping reduce the impact of volatility.

- Emotion removal: This systematic approach eliminates emotional decision-making about market timing.

- Risk management: By spreading sales across time, you avoid the risk of selling everything at a market bottom

3️⃣ Gradual Sales

Similar to DCA but triggered by market conditions rather than time:

- Percentage-based selling: Sell specific percentages of your holdings when Ethereum reaches predetermined price targets.

- Scaling out: Gradually reduce your position as prices rise, allowing you to lock in profits while maintaining some exposure.

- Market condition triggers: Unlike fixed-schedule DCA, this approach responds to specific market developments or technical signals.

Common Mistakes to Avoid When Selling Ethereum

Emotional Decision Making

Letting fear or greed drive your moves is a recipe for losses. Panic selling during dips or FOMO-driven buys at peaks often locks in losses or buys high. For example, selling ETH during a 20% crash might feel safe, but missing its rebound hurts returns.

Similarly, chasing pumps because “Ethereum might hit $10k soon!” ignores realistic technical analysis. Set strict rules: use stop-loss orders at 15-20% below current prices or dollar-cost averaging (DCA) to sell portions systematically. Stick to your plan even when the crypto market feels chaotic.

Ignoring Market Trends

Overlooking ETH’s ties to Bitcoin or broader trends can backfire. If Bitcoin crashes, Ethereum often follows—selling blindly without checking BTC’s charts or news (like ETF approvals) risks poor timing. Seasonal patterns matter too: historical data shows ETH/BTC ratios often dip in December, which could hint at better selling windows in May.

Ignoring support/resistance levels or RSI signals (like RSI >70 indicating overbought conditions) also leaves you vulnerable. Track both Ethereum network upgrades and macro shifts, like regulatory crackdowns on exchanges.

Improper Tax Planning

Forgetting taxes can erase profits. Short-term holdings (under 1 year) face higher capital gains taxes—up to 37% in the U.S. vs. 15-20% for long-term. Not tracking cost basis (original ETH purchase price) leads to miscalculations. Missed tax-loss harvesting?

Selling other crypto at a loss could offset ETH gains. Keep records: dates, amounts, wallet addresses, and bank transfers. Consult a tax pro to navigate rules, especially with DeFi transactions or staking rewards, which have unique reporting requirements.

Where Could Ethereum Reach Next?

Ethereum Prediction For 2025 and 2030

Expert forecasts for Ethereum’s future value vary widely:

- Near-term projections: Historical patterns suggest selling opportunities might emerge in May 2025 (based on the 150-day pattern following December bottoms) or September 2025 (based on the 500-day post-Bitcoin halving pattern).

- Long-term outlook: Some analysts maintain bullish perspectives on Ethereum, with predictions reaching over $20,000 by 2030.

- ETH/BTC ratio forecasts: Previous cycles saw this ratio reach approximately 9% (versus current levels around 3.8%), suggesting potential room for relative growth against Bitcoin.

Will Ethereum ever Outperform Bitcoin?

The question of whether Ethereum will outperform Bitcoin remains hotly debated:

- Technological advantages: Ethereum’s smart contract capabilities and ecosystem development could drive increased utility and demand.

- Cyclical patterns: Historical data shows the ETH/BTC ratio follows somewhat predictable cycles, with peaks and troughs often occurring in specific months.

- Institutional interest: ETF approvals and institutional adoption patterns for both assets will significantly influence their relative performance.

While some analysts believe Ethereum’s utility could eventually drive higher relative performance, others maintain Bitcoin’s position as the primary cryptocurrency will ensure its continued dominance as a store of value.

Alternatives to Selling Your Ethereum

Holding for Long-Term Growth

If you believe in the Ethereum network, holding ETH as a store of value can pay off. Many investors see Ethereum as the backbone of smart contracts, DeFi, and blockchain innovation, expecting ETH price to rise with wider adoption.

By holding through market volatility, you avoid paying capital gains tax and keep your digital assets ready for future buying opportunities or portfolio growth. This strategy is popular among those who see ETH outpacing other tokens like Solana or XRP over time.

Staking Your Ethereum

Staking lets you earn passive income by locking up ETH to support the network. When you stake through apps or exchanges, you get rewards (in ETH) that boost your holdings. Staking is safer than trading in volatile markets, and your ETH never leaves your wallet or hardware device. Just remember, staked ETH can be locked for a set period, so make sure it fits your investment goals and risk tolerance.

Using Ethereum in DeFi Applications

Instead of selling, you can use ETH as collateral in DeFi apps to earn interest, borrow stablecoins like Tether or USD, or provide liquidity for trading pairs. DeFi platforms use smart contracts, so you keep control of your crypto while putting it to work. This way, you gain extra yield without losing exposure to ETH price movements, but always check the platform’s security and market conditions before jumping in.

Diversifying Your Cryptocurrency Portfolio

You don’t have to sell all your ETH—consider reallocating a portion into Bitcoin, Arbitrum, Solana, or even ETFs for broader exposure. Diversification helps manage volatility and reduces risk if one token or the crypto market takes a hit. Use technical analysis and your own research to decide which digital assets fit your strategy, and always use secure wallets and trusted payment methods for any transfers.

FAQ’s:

Is it worth keeping my Ethereum?

Whether keeping Ethereum is worthwhile depends on your investment timeline, risk tolerance, and belief in the network’s long-term potential. Most accomplished investors argue that a HODL strategy often yields the best long-term results, but you must be comfortable with market volatility. Consider your personal financial goals, Ethereum’s ongoing technological development, and broader market trends before deciding.

When is the best time to sell Ethereum?

Historical data suggests two potential timing strategies: approximately 150 days after December bottoms in the ETH/BTC ratio (pointing to May 2025) or around 500 days after Bitcoin halving events (indicating September 2025)8. However, the optimal time varies based on individual circumstances, market conditions, and your specific investment goals.

How do I minimize taxes when selling Ethereum?

To minimize taxes when selling Ethereum, consider holding assets for over a year to qualify for long-term capital gains rates, using tax-loss harvesting strategies to offset gains with losses from other investments, and potentially using tax-advantaged accounts where available. Always consult with a tax professional familiar with cryptocurrency regulations in your jurisdiction.

Should I sell all my Ethereum at once?

Selling all your Ethereum at once creates significant market timing risk. Most experienced traders recommend graduated selling strategies like Dollar-Cost Averaging or selling at predetermined price targets to reduce timing risk and emotional decision-making. This approach helps protect against selling everything at suboptimal prices.

What are the safest platforms to sell Ethereum?

The safest platforms to sell Ethereum include established exchanges with strong security measures, regulatory compliance, and positive user reviews. Look for exchanges that offer two-factor authentication, cold storage of assets, insurance protection, and transparent fee structures. Popular options include major regulated exchanges with proven track records such as Binance, Coinbase, Robinhood, etc.

How do I protect myself from scams when selling Ethereum?

Protect yourself from scams by using only reputable exchanges, enabling all available security features, verifying wallet addresses multiple times before transactions, avoiding clicking links in emails or messages about your cryptocurrency, and storing your ETH in a hardware wallet until you’re ready to sell. Never share private keys or seed phrases with anyone.

Conclusion

Deciding whether to sell your Ethereum involves evaluating market conditions, financial goals, tax implications, and alternative uses for your ETH, like staking or using it in DeFi apps. Given the crypto market’s volatility, timing is crucial—historical trends suggest May or September 2025 as potential selling windows. Define clear objectives: Are you seeking short-term profits, long-term growth, or diversification with assets like Bitcoin or ETFs?

Consider tax implications since selling ETH can incur capital gains taxes; strategies like tax-loss harvesting can help manage this. Assess your risk tolerance—if market fluctuations cause anxiety, consider selling some ETH or diversifying into stablecoins like Tether.

Use technical analysis and monitor ETH price trends alongside BTC movements and blockchain news to guide your decisions. Avoid emotional selling; adhere to your plan and employ tools like stop-loss orders or dollar-cost averaging to navigate volatility. Always secure your digital assets in a safe wallet and transact on trustworthy platforms.

While some experts are optimistic about Ethereum’s long-term potential as a store of value and smart contracts leader, others advocate reallocating to BTC or other cryptocurrencies. Ultimately, align your decision with your overall investment strategy and comfort level with market fluctuations.